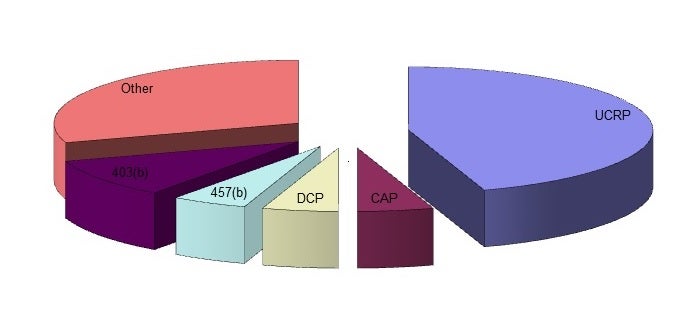

The University of California Retirement System (UCRS) is an attractive and comprehensive retirement system. It offers UC employees a generous pension plan (UCRP) and an assortment of retirement savings plans [DCP/401(a), 403(b), 457(b)] enabling employees to achieve a secure retirement following their UC career. The information provided on this website is a synopsis of the University of California Retirement System Plans; these plans are governed by University of California Retirement System Plan Document regulations. Notice: UCRS Plan Document Regulations take precedence over this summary.

As you can see above, there are many pieces to the UCRS "pie." These pieces, although under one system, are individual plans and provide UC retirees with income, independent of each other. The plans, when paid to retirees, will be subject to ordinary income tax, except where indicated. Let’s take a look at the individual pieces — University of California Retirement Plan (UCRP), Capital Accumulation Provision (CAP), 401(a) Defined Contribution Plan, and 403(b) and 457(b) Voluntary Retirement Savings Accounts — under Related Information.

Campus Human Resources, Benefits Services

Phone: (310) 794-0830 | Fax: (310) 794-0835